Posts

Showing posts from May, 2008

Best Free Websites For Saving Money On Travel

- Get link

- Other Apps

New Investopedia Article: Get Emotional Spending Under Control

- Get link

- Other Apps

Things Your AAA Membership Can Save You Money On

- Get link

- Other Apps

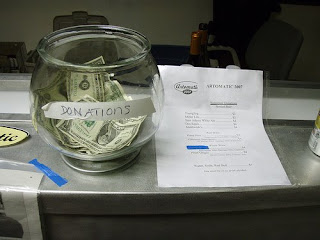

Why You Should Donate Your Entire Stimulus Package Check to Charity

- Get link

- Other Apps

Treasure Finding Tips From A Garage Sale Junkie

- Get link

- Other Apps

Debt Reduction Mistake: An Expensive Car Purchase

- Get link

- Other Apps

Navigating Real Estate Listing Lingo

- Get link

- Other Apps

Why You Should Use A Buyer's Agent

- Get link

- Other Apps